What if I told you that chasing invoices and updating spreadsheets is quietly costing your business more than a senior employee's salary?

For most companies with 20-80 people, it is. The worst part? You can't even see it on your P&L. It’s a slow, invisible bleed that drains your cash, frustrates your team, and makes you less competitive. And it’s hiding in plain sight, disguised as “the cost of doing business.”

I've spent years examining the operational details of hundreds of businesses just like yours. I’ve seen firsthand how owners and COOs are so focused on the big picture, sales, production, and customer happiness that they miss the thousands of tiny cuts from manual administrative work that are eroding their profitability. You didn't get into business to watch your team copy and paste data all day. You got into it to solve problems and grow. I’m here to show you where the money is leaking and how to plug the hole, fast.

You know the drill. Someone in sales closes a deal, then manually enters the data into the CRM. Someone in finance receives the PDF invoice and then manually types it into the accounting system. Someone in ops spends two hours every Friday updating a master spreadsheet that everyone is terrified to touch.

Each task seems small. Five minutes here, ten minutes there. Who cares, right?

You should because it's never just five minutes. That manual data entry has a 4% error rate. That invoice gets keyed in wrong. The spreadsheet crashes. Now you're not just paying for the original task; you're paying 3x more for the rework, the customer service calls to fix the mistake, and the management time to put out the fire.

It's a multiplier effect. And it's happening in every corner of your business, every single day.

Think of these five tasks as silent thieves on your payroll. They don't have names or desks, but they’re collecting a hefty paycheck every month. The research is clear: these five areas are where SMEs bleed the most cash.

This is the classic “swivel-chair” job. Taking information from an email and typing it into a system. Your team spends, on average, 15 hours a week just on this. With a 4% error rate, you're not just wasting time; you're building a foundation of insufficient data that will cause problems for weeks to come.

Manually processing a single invoice costs you between $12 and $25. (Yes, really.) Compare that to the $2 to $5 for an automated system. If you process just 300 invoices a month, you could be burning over $60,000 a year just in your accounts payable department. This is the single most expensive manual admin function. Period.

How many hours does your sales or accounts team spend sending follow-up emails? The average is about 12 hours a week across the team. Every one of those emails is a moment they could have spent talking to a high-value customer or solving a real problem. Automated follow-ups typically yield 8 times the engagement anyway. You're paying more for worse results.

Ah, the master spreadsheet. The one that runs your entire operation. It also consumes about 10 hours of team time a week just to keep it updated. And get this: manual spreadsheet work has the highest error rate of all, at a whopping 5%. You're making critical business decisions on data that's more likely to be wrong than anything else.

This is the hidden killer. Correcting all the mistakes made by the other four is the most expensive work your team does. It takes an expert to untangle the mess, and the cost to fix an error is about 3 times the cost of doing it right the first time. One study found that fixing a single botched expense report costs an extra $52. Now multiply that across your entire business.

Still think it's just a slight inefficiency? Let's put some numbers to it.

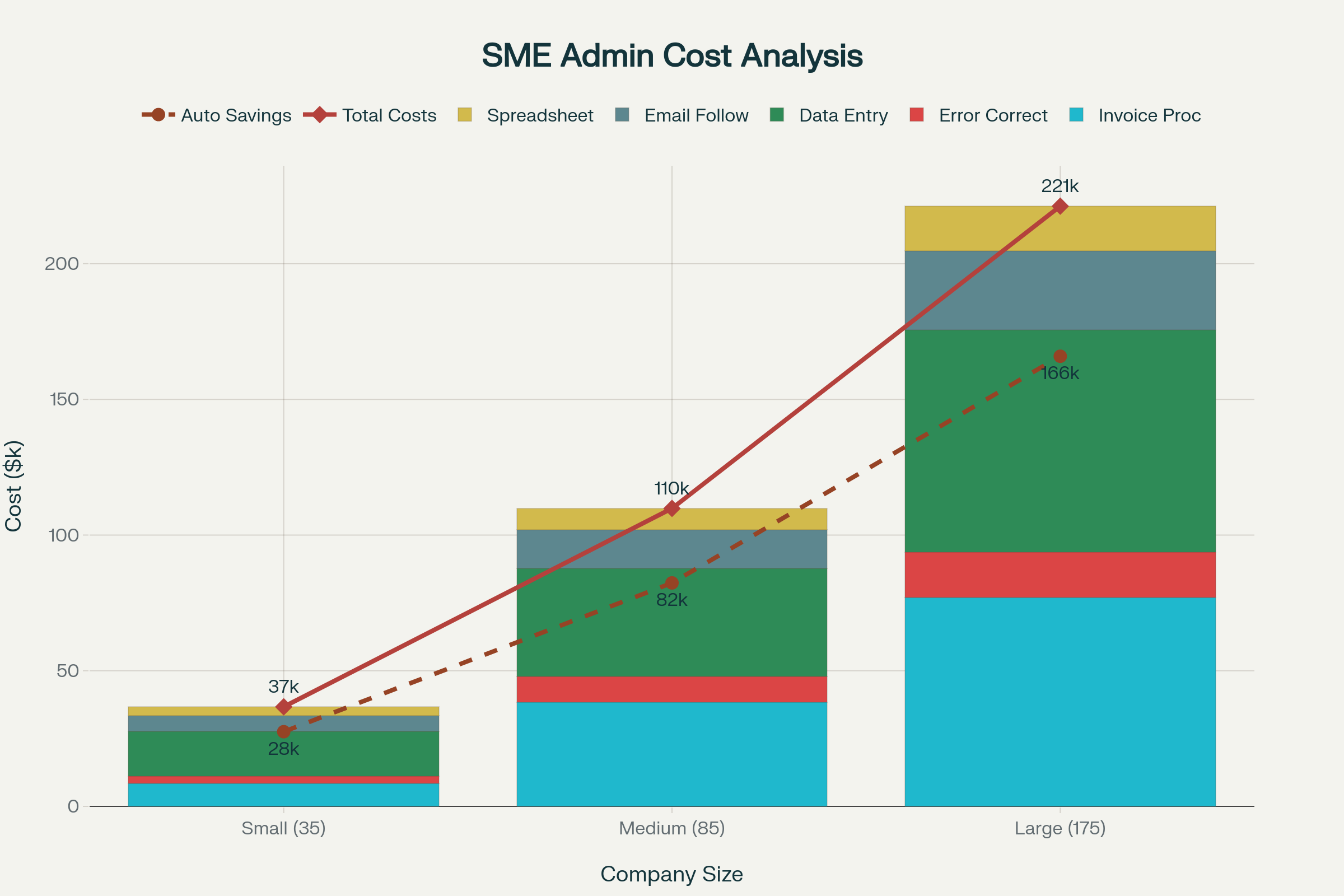

For a typical 85-person company, the combined cost of these five manual processes isn't a few thousand dollars. It's $109,819 per year.

One hundred and nine thousand dollars. Gone.

For a smaller team of 35, it's still a painful $36,702. For a larger SME with 175 employees, the number increases to over $221,000. That's not Monopoly money. That's cash you could be using for a key hire, a new piece of equipment, or your bottom line.

I can hear you thinking it now. "Great, another problem. But automation is expensive, complicated, and we don't have time for a big tech project."

That used to be true. It isn’t anymore.

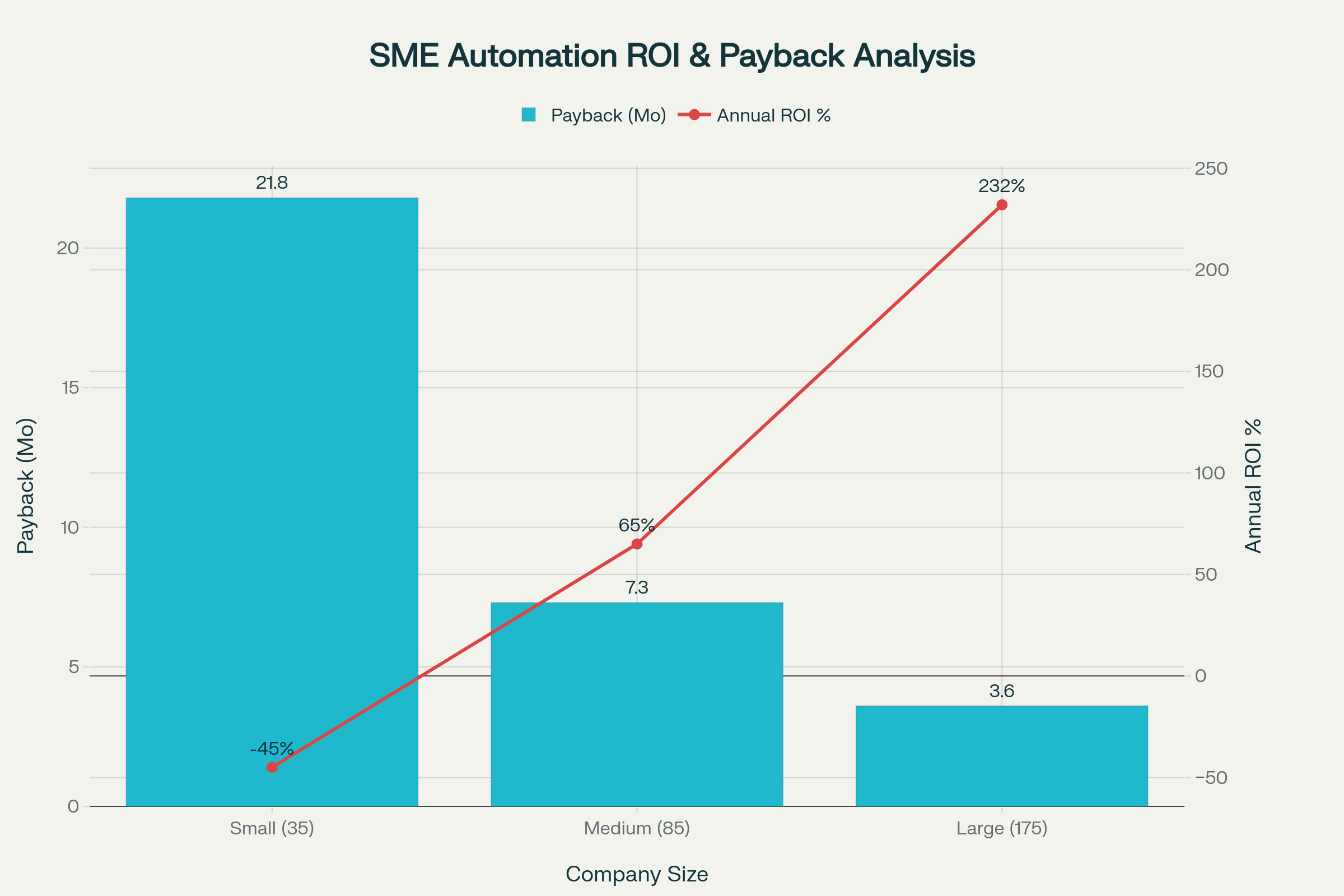

The data from over 2,800 businesses shows that 73% get a positive ROI on automation within 30 days. The payback for that 85-person company we talked about? Just over 7 months. After that, it's pure savings.

Look at REVA Air Ambulance. They were spending 20 minutes manually processing every single invoice. After automating, it took them under 3 minutes. They accelerated their month-end closing by two whole weeks. This isn't science fiction; it's off-the-shelf technology that works right now.

This isn't just theory. Look at

REVA Air Ambulance, which cut its invoice processing time by over 80%—from 20 minutes down to 3—and started closing its books two weeks faster.

Or The Second City comedy theater, which saved $40,000 in cash annually simply by switching to a more effective AP automation tool.

And API, a healthcare distributor, automated 70% of its invoices, cutting its processing staff needs by 25%. These are real businesses getting real money back.

You don't need to boil the ocean. You just need to identify the largest leak and seal it. Here's a simple, reversible plan you can start on Monday.

Don't try to fix everything at once. Pick ONE of the "Big 5" that's causing the most pain. Is it the nightmare of invoice approvals? Or the spreadsheet that keeps breaking? Ask your team. They’ll tell you. (Believe me, they will.)

Forget massive software rollouts. Find a modern, no-code tool and test it on a small slice of the problem. Automate one vendor's invoices. Or one sales team's follow-up sequence. Scope it to 4-6 weeks. Set one clear success metric, like "cut invoice processing time by 50%." If it doesn't work, you turn it off; it's a low-risk, high-reward approach.

This is the part your CFO will love. Use this simple formula:

Net Monthly Savings = (Hours Saved × Loaded Hourly Cost) - (Software Cost)

Once you prove the payback on one small process, you have a business case to pursue the next one. You become a hero, not a cost center.

Want to guarantee a fast payback? The research on thousands of companies shows the winners do three things consistently:

These hidden costs are a choice. You can keep letting them bleed your company dry, disguised as "business as usual." Alternatively, you can take a small, smart step to address the biggest problem and watch the time and money flow back into your business.

So, what's the first leak you're going to plug?

More insights from the best-practices category

Get the latest articles on AI automation, industry trends, and practical implementation strategies delivered to your inbox.

Discover how Xomatic's custom AI solutions can help your organization achieve similar results. Our team of experts is ready to help you implement the automation strategies discussed in this article.

Schedule a Consultation